Car insurance is a legal requirement for drivers across the United States, but for students, the cost can feel overwhelming. Young drivers often face higher premiums due to limited driving experience and statistically higher accident risks. As a result, many families and college students actively search for cheap car insurance for students in USA to stay protected without straining their budgets.

The good news is that affordable options do exist. Insurance companies offer student-focused discounts, flexible coverage plans, and usage-based programs designed to reduce costs. Understanding how these policies work and what they include can help students and parents make informed decisions while remaining fully compliant with state laws.

What are Cheap Car Insurance for Students in USA

Cheap car insurance for students in USA refers to affordable auto insurance policies specifically designed or discounted for high school and college students. These policies provide essential financial protection in case of accidents, theft, or vehicle damage, but at lower premiums compared to standard rates for young drivers.

Major insurance providers such as State Farm, GEICO, Progressive, and Allstate offer student discounts and specialized programs.

These affordable policies may include:

Liability coverage (required by law)

Collision and comprehensive coverage (optional but recommended)

Good student discounts

Distant student discounts (for students studying away from home without a car)

Usage-based insurance programs

The goal is to provide adequate coverage while minimizing financial burden.

How are Cheap Car Insurance for Students in USA Work

Cheap car insurance for students works similarly to standard auto insurance but incorporates pricing adjustments and discounts tailored to students.

Here’s how it typically works:

Risk Evaluation – Insurers assess the student’s age, driving record, vehicle type, and location. Younger drivers usually face higher base rates.

Discount Qualification – Students may qualify for discounts such as:

Good student discount (usually for maintaining a B average or higher)

Driver training course discount

Safe driving monitoring programs

Multi-policy or family policy discounts

Coverage Selection – Students can choose minimum liability coverage to meet state requirements or add comprehensive and collision coverage for better protection.

Premium Calculation – The final premium reflects applied discounts, chosen coverage limits, and deductible amounts.

Ongoing Adjustments – Maintaining good grades and a clean driving record can help keep premiums low over time.

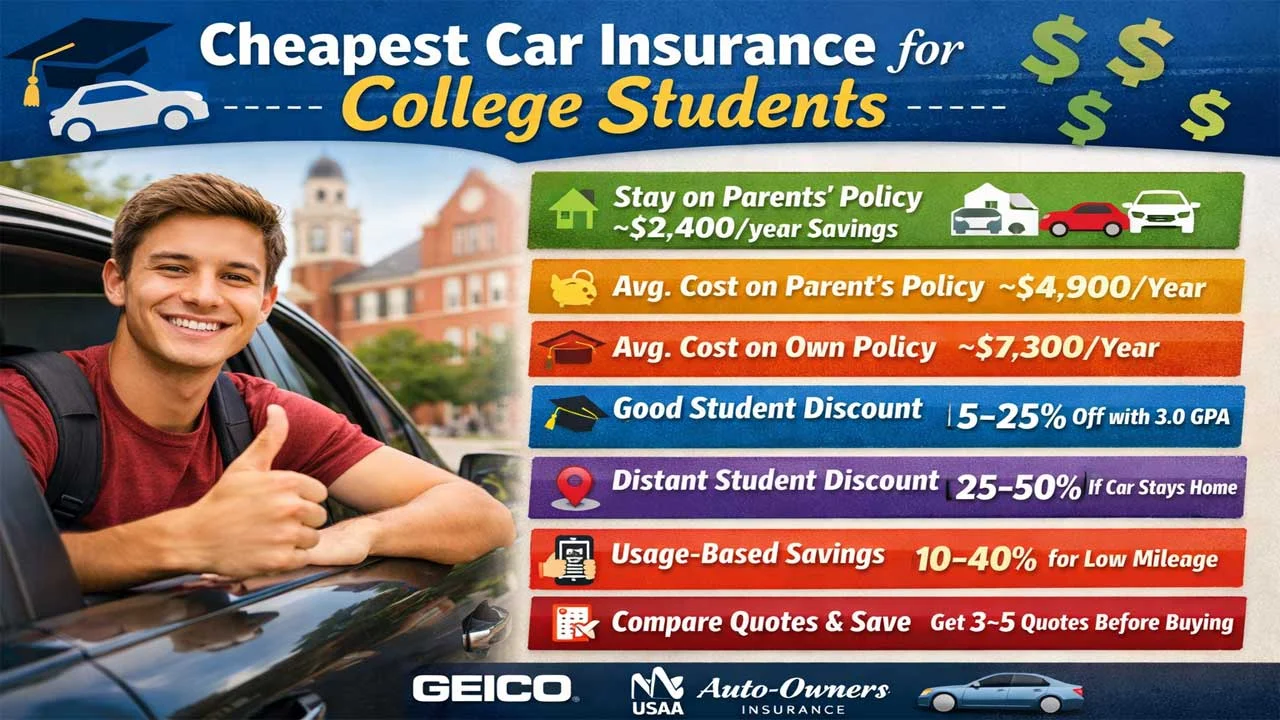

Many students reduce costs by staying on their parents policy rather than purchasing a separate one.

Features of Cheap Car Insurance for Students in USA [Completely Detailing]

Affordable student car insurance policies often include several essential features:

1. Liability Coverage

This is mandatory in most states and covers bodily injury and property damage caused to others in an accident.

2. Collision Coverage

Pays for repairs to the student’s vehicle after an accident, regardless of fault.

3. Comprehensive Coverage

Protects against non-collision incidents such as theft, vandalism, fire, or severe weather.

4. Good Student Discount

Students maintaining strong academic performance (typically a GPA of 3.0 or higher) may qualify for reduced premiums.

5. Usage-Based Insurance

Some insurers offer telematics programs that track driving behavior through a mobile app or device. Safe driving habits can lead to additional savings.

6. Distant Student Discount

If a student attends college far from home and does not bring a car, insurers may reduce premiums significantly.

7. Flexible Deductibles

Choosing a higher deductible lowers monthly premiums, although it increases out of pocket costs in case of a claim.

8. Roadside Assistance Options

Many insurers offer affordable add-ons like towing, battery jump start, and emergency fuel delivery.

Pros of Cheap Car Insurance for Students in USA

| Pros | Explanation |

|---|---|

| Affordable Premiums | Designed to reduce costs for budget-conscious students. |

| Academic Rewards | Good grades can translate into insurance discounts. |

| Flexible Coverage | Students can customize coverage based on needs. |

| Encourages Safe Driving | Usage-based programs reward responsible driving habits. |

| Family Policy Savings | Staying on a parent’s plan often lowers overall costs. |

Cons of Cheap Car Insurance for Students in USA

| Cons | Explanation |

|---|---|

| Higher Base Rates | Young drivers are considered higher risk. |

| Limited Coverage | Minimum policies may not fully protect the vehicle. |

| Deductible Trade-Off | Lower premiums often mean higher deductibles. |

| Rate Increases After Accidents | Claims or violations can significantly raise premiums. |

| Eligibility Restrictions | Discounts may require academic proof or monitoring enrollment. |

Cheap Car Insurance for Students in USA Alternatives

| Alternative | Description | Best For |

|---|---|---|

| Parent’s Insurance Policy | Adding the student to an existing family plan. | Full-time students living at home |

| Usage-Based Insurance | Rates based on driving habits tracked digitally. | Safe drivers with low mileage |

| Pay-Per-Mile Insurance | Premiums based on miles driven monthly. | Students who drive infrequently |

| Higher Deductible Plan | Lower monthly premiums with higher claim costs. | Students with emergency savings |

| Regional Insurance Providers | Smaller local insurers offering competitive student rates. | Students seeking personalized service |

Conclusion and Verdict Cheap Car Insurance for Students in USA

Cheap car insurance for students in USA is achievable with careful research and smart decision-making. Although young drivers typically face higher premiums, numerous discounts and flexible coverage options can significantly reduce costs.

Students should compare quotes from multiple insurers, maintain good academic performance, and practice safe driving to qualify for the best rates. Remaining on a parent’s policy, choosing appropriate deductibles, and exploring usage-based programs can also make a meaningful difference.

Ultimately, the best policy is not just the cheapest one, but the one that offers sufficient protection at an affordable price. By understanding coverage options and available discounts, students can secure reliable insurance coverage while staying within their financial limits.